Goods and Services Tax (GST) is a mandatory indirect tax in India for most businesses, aimed at simplifying tax compliance and creating a unified market. Whether you are a manufacturer, supplier, retailer, or service provider, understanding GST registration and filing is essential for compliance, legal operations, and smooth financial management.

This post will guide you through who needs GST registration, how to register, filing procedures, and key compliance tips.

Table of Contents

Why GST Compliance Matters

Legal Requirement: Mandatory if turnover exceeds ₹20 lakh (₹10 lakh for NE/North East states) or if engaged in interstate supplies.

Input Tax Credit (ITC): Allows offsetting GST paid on purchases against output tax liability.

Business Credibility: Clients and suppliers prefer GST-compliant businesses.

Avoid Penalties: Non-compliance can lead to fines, interest, or legal issues.

Treat GST as a financial system for your business, not just a tax. Correct registration and timely filing save time, money, and stress.

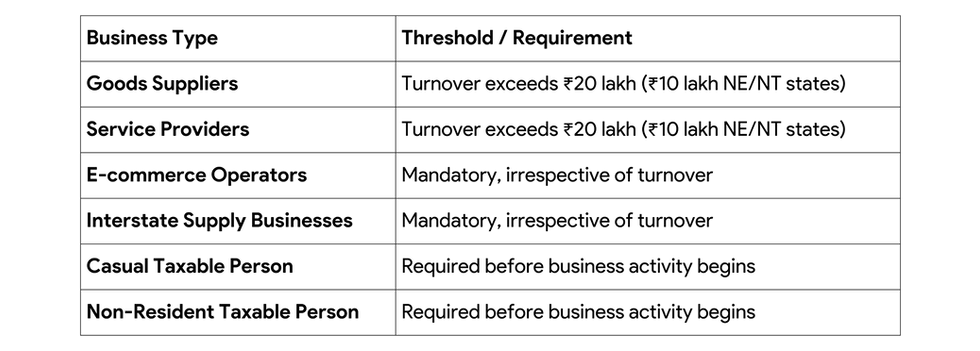

Who Needs GST Registration

GST Registration Process

Step 1: Gather Required Documents

PAN of business entity

Aadhaar of proprietor / promoters

Proof of business address (utility bill, rent agreement)

Digital photograph of proprietor / authorised signatory

Bank account details (cancelled cheque or statement)

Business constitution documents (Partnership deed, LLP agreement, or incorporation certificate for Pvt Ltd)

Step 2: Register Online via GST Portal

Visit GST Portal

Create a Temporary Reference Number (TRN)

Submit required documents digitally

Verify PAN and Aadhaar via OTP

Upload supporting documents

Complete verification with Digital Signature Certificate (DSC) if applicable (for LLP/Pvt Ltd)

Receive GSTIN (GST Identification Number) within 7–10 working days

Keep a digital and physical copy of your GST registration certificate for reference.

Types of GST Returns

Step-By-Step GST Filing Guide

Step 1: Collect Data

Compile invoices for sales, purchases, input credits, and exports.

Ensure GSTINs of suppliers and customers are correct.

Step 2: Prepare Returns

Fill GSTR-1 with details of outward supplies.

Review auto-populated GSTR-2A/2B for inward supplies.

Calculate GST liability for GSTR-3B.

Step 3: Payment

Pay GST liability online via net banking or authorised banks.

Keep payment challans for records.

Step 4: Submit Returns

File GSTR-3B by the 20th of every month for the previous month.

File GSTR-1 by the 11th of the following month.

Reconcile invoices to avoid mismatches and notices.

GST for Special Schemes

A. Composition Scheme

Simplified GST for small businesses with turnover ≤ ₹1.5 crore.

Pay a fixed percentage of turnover instead of full GST rates.

Cannot claim ITC.

B. E-Commerce Operators

Mandatory GST registration irrespective of turnover.

Collect tax at source (TCS) from suppliers.

C. Exporters

Zero-rated GST applies on exports.

Input tax credit is refundable.

Accounting and Software Tips

Use Tally, Zoho Books, QuickBooks, or ClearTax GST software to manage GST.

Auto-generate invoices in GST-compliant format (GSTIN, HSN codes).

Regularly reconcile input tax credit to avoid discrepancies.

Common Mistakes to Avoid

Filing returns late, resulting in penalties.

Incorrect GSTINs for suppliers/customers.

Mismatched invoices leading to ITC rejection.

Ignoring nil returns if no business activity occurred.

Mixing personal and business transactions in accounting.

Maintain an organised GST folder with invoices, payment receipts, and ITC claims.

Insights

Organise GST documents digitally: Keep sales, purchase invoices, and payment proofs in a folder sorted by month for easy filing.

Set reminders for filing deadlines: A monthly calendar prevents late filing and penalties.

With GST registration and filing mastered, the next step is to understand industry-specific licenses and permits to operate fully legally.

Read: Understanding Licenses and Permits by Industry

(A guide to mandatory compliance for different business sectors)